Spending money

What is needed to make a budget?

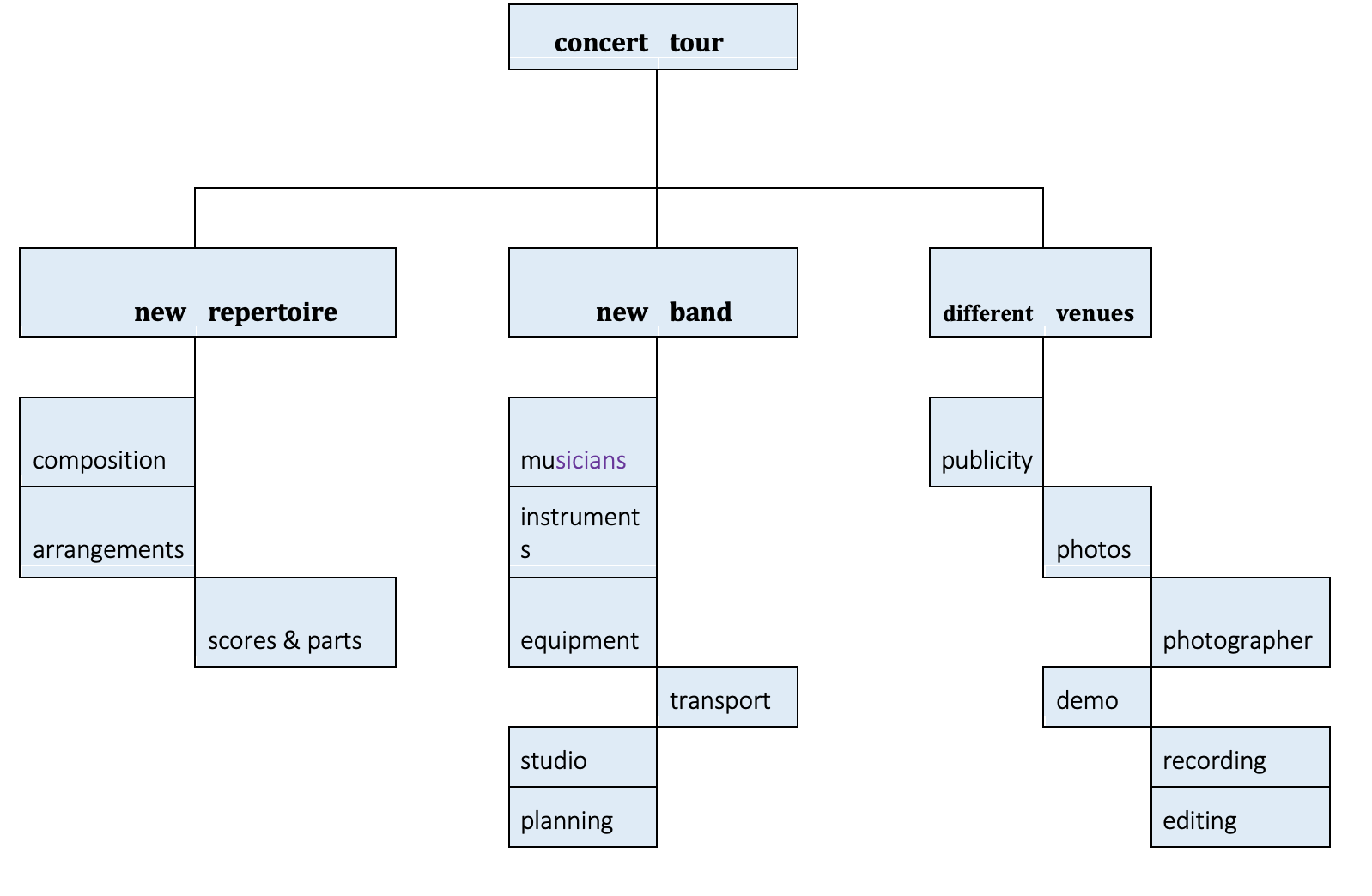

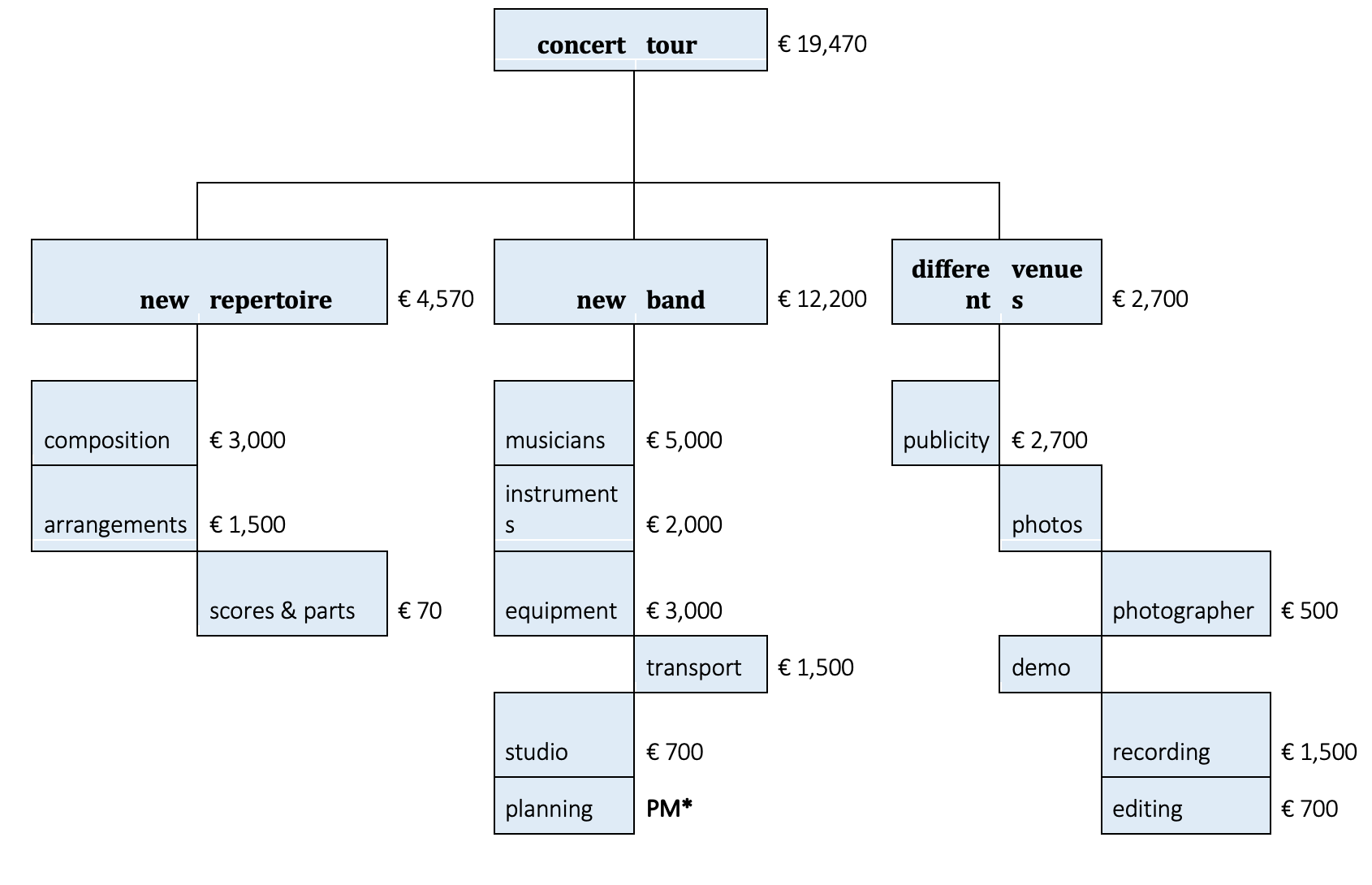

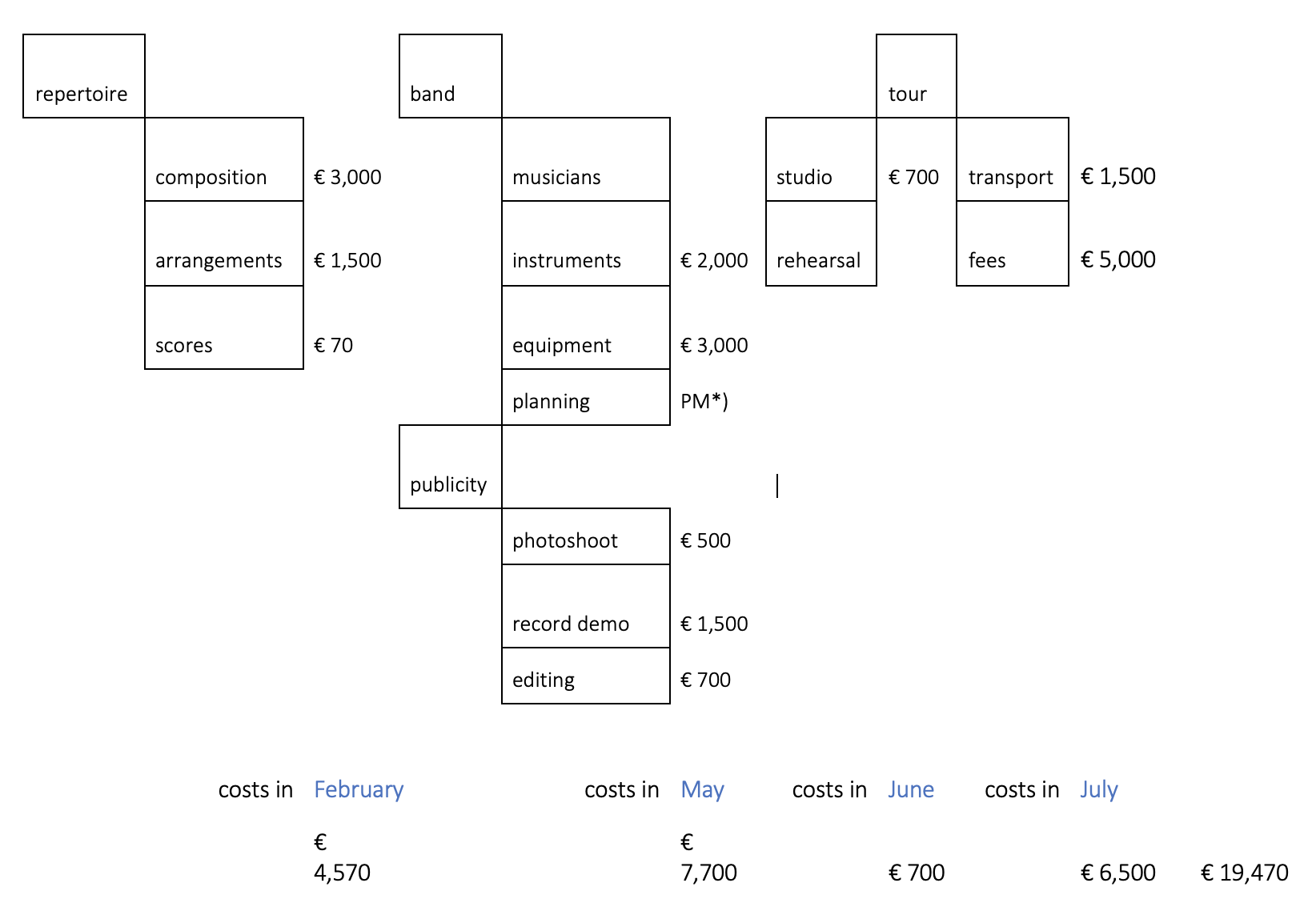

Product-Based Planning

The outcomes of the process of Product-Based Planning are the main ingredients for a budget.

The Product Breakdown Structure will help define what products in a project will cost money.

The product descriptions will define how much they will cost, based on their quality descriptions.

*) PM Pro Memory stands for token entry = an entry taken notice of, that does not need to be capitalised. In this example, the planning was made in half an hour by all band members during a rehearsal. The rehearsal was paid, therefore the time invested in planning did not have to be paid as such.

The Product Flow Diagram will define in what order these investments or costs will be made and what actions (labour) are connected with obtaining these products and help to make a layered timetable.

All the information acquired in the PBP will help to make an estimation of investments needed and costs for products and labour, and give insight into when these costs or investments need to be made.

Management of Risks!

A risk log will give insight into the weight of risk and the countermeasures to be taken. These countermeasures need to be included in the budget. A generally accepted form of risk management in the performing arts is the formula of a certain percentage of unforeseen expenditures (=unforeseen expenses), usually around 7% of the actual activity costs.

What are the main components of a budget?

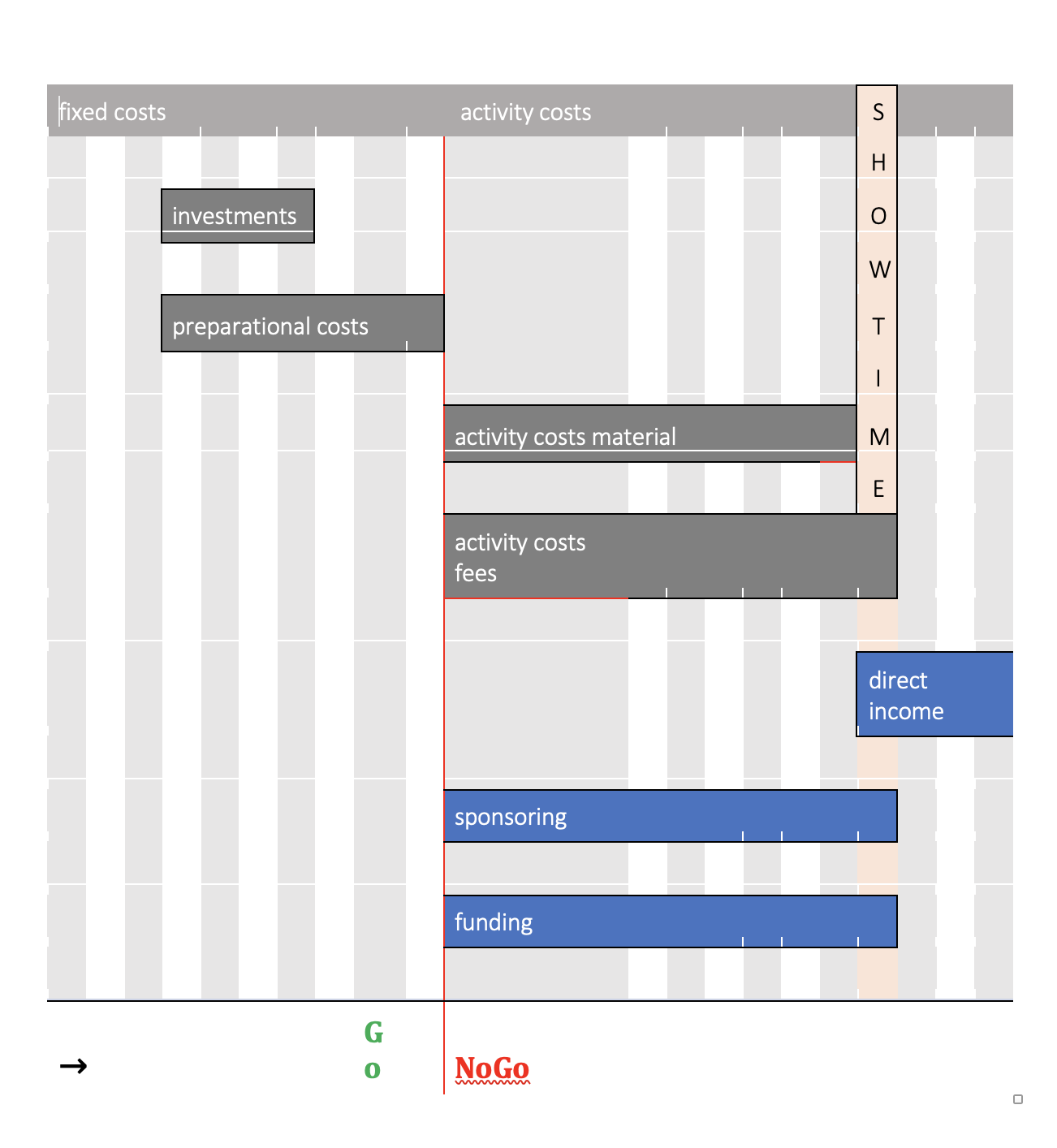

fixed costs

Fixed costs are costs that have to be made anyway – no matter whether a project takes place or not (costs for mobile phone, computer, instrument, etc.). Costs that are mostly paid every month regardless of the projects or activities but can be incorporated in a project budget.

preparatory costs

These are connected with the investments made in the preparation of a project, when it is not even sure the project will take place.Therefore, they contain a risk and should be kept as low as possible.

investments

Investments may include labour/time invested by others that may only be compensated or paid back when the project is successfully completed. That could be investments made in kind (labour, using facilities or instruments without paying for them) as well as real investments in money, shares or loans. There needs to be an agreement with those who invest in a project on how to refund or pay them in the long term and how the risk of not returning the investment is shared.

activity costs: material & services

In general, those costs that arise when a project is actually running (after a phase of preparation) are called ‘activity costs’. Think of material for building products or equipment to rent or of the services of a designer, photographer, etc. Designers or photographers may have fixed prices that are not dependent on the number of hours they invest in delivering a design or a set of photos.

activity costs: fees

All costs for people (including yourself!) that are counted in the amount of time spent on creativity and labour in a project. These are costs that have to be negotiated and defined beforehand.

dues and taxes

These can be VAT, royalties, etc. These costs are often forgotten in a budget.

direct income

This is income for labour (performing, dancing, leading a workshop or masterclass, teaching, etc.) or selling a product (a method, a CD, a book, a new musical instrument, a piece of equipment, new software, an app) as the deliverable of a project. Benefits that can come in various forms: revenues of selling tickets at the box-office, receiving buy-outs from venues[CD1] , people buying products or merchandise, collecting copyright and neighbouring rights, making money with advertisements, or monetising social media content.

sponsorship or endorsement

Parties that invest in a project but want something in return. Think of a drummer who gets a set of cymbals for free but appears in advertisements of the cymbal manufacturer to promote the brand. Or the actor playing James Bond drinking a Dutch brand of beer.

funding

Financial support from governmental or private funds that support the performing arts, or crowdfunding.

patrons or maecenas*

Wealthy individuals that support arts and artists.

*in many languages the word maecenas is used for patron

How do these components appear in the timetable of a project budget?

The Go-NoGo moment

Every project has it’s Go-NoGo moment. That is the moment of no return when activity costs (the most substantial part of the budget) start being made. The essence of budgeting is that it helps to identify the Go-NoGo moment in a project. At the Go-NoGo moment, the decision is made to continue with a project or to stop it, in order to avoid taking irresponsible financial risks.

So how to create a budget?

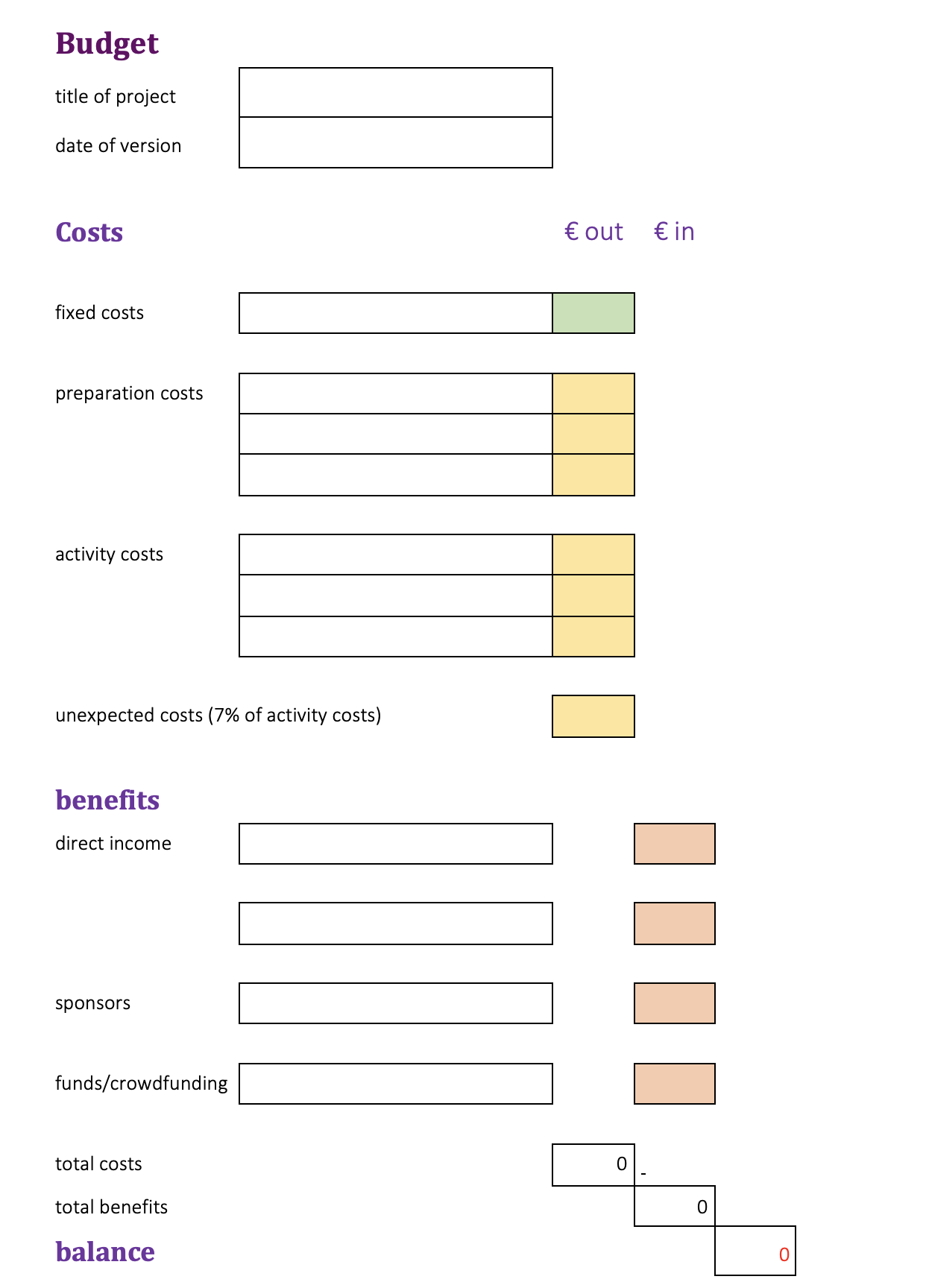

As budgeting includes calculating numbers, programmes like Excel or Numbers are very helpful for designing a budget. This is the basic outline of a budget in Excel.

When adding elements to your budget, always be clear about the price per ‘unit’ and the number of ‘units’. For example:

marketing and publicity costs: 20 hours at €35/hour = €700

ticket sales: 100 tickets at €20/ticket = €2,000

Why does the balance always have to be 0 (zero)?

In all phases of a project, the balance in a budget has to be zero: the benefits should equal the costs; column total costs equals column total benefits. All assumptions about costs and benefits have to be in balance. At the Go-NoGo moment all the information available about costs and benefits needs to show a balance that is zero. In the final realisation, the balance will still be zero.

Can I make money with a project?

Yes, you can and hopefully you will. Working on a project, you can put yourself in the budget as (one of the) collaborator(s) receiving a fee. You can calculate all the hours you invest and add them to the costs. This can be in different roles: as one of the musicians performing, as the organiser or producer or the one taking care of marketing or fundraising. Make sure you include each of your roles and the time spent in your budget.

If you decide to invest your time without receiving a fee yourself, you capitalise that amount of time as ‘your own contribution’ and list them under the benefits in your budget.